Giving

Why Give?

Jesus taught that God is our provider. The Bible teaches that each of us is valuable to God and that He looks out for all the things that we need. In response to God’s generosity, He calls us to be generous to others including to the work of His church. As we grow in our relationship with Jesus, our hope is that the whole of our lives would show our love for Him. Giving financially is part of this.

Money given to the church goes to:

- to serve the local community and to encourage in faith those in the church including children and young people

- financially support churches working in deprived areas of the diocese

- financially support those serving in churches overseas.

Over 90% of All Saints’ income comes from congregation members. If you are interested how money is spent in this church, then please contact our Treasurer, Guy Wingate who will be happy to explain further.

There are several ways to give to the work of All Saints’ Church:

Parish Giving Scheme

This is the easiest way to give regularly to All Saints’. It is a direct debit arrangement which collects Gift Aid for us, and it allows you to make a regular monthly, quarterly, or annual payment to All Saints’. If you would like to set this up there is more information about the scheme and how to set it up here. Our parish code 130613312.

Give online

You can give a one off donation online by clicking the button below.

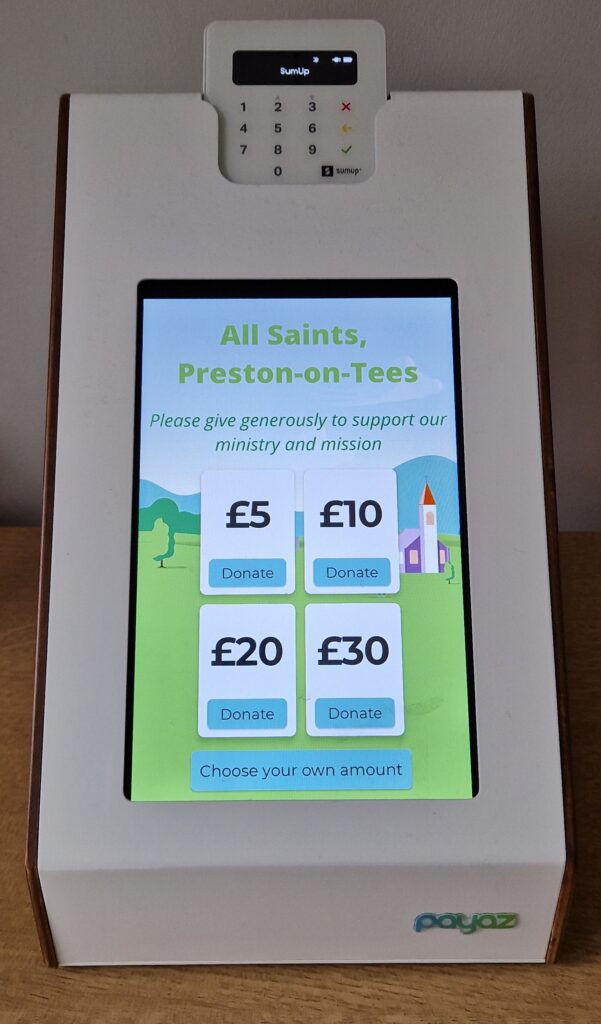

Contactless Giving

We have a contactless giving machine which is located in the reception area of our church centre. You can select the amount you would like to donate and make a payment with your bank card.

Other Ways to Give

- We can provide you with giving envelopes. Please contact our treasurer for more details about these or if you would like to give in a different way.

- We don’t pass a collection plate round during our services, however there is a wooden plate at the back of the church if you would like to give when you are in a service.

- If you are considering leaving a legacy to the church, please contact our treasurer who will be able to help you.